LOCAL INCENTIVES

Tax Abatement Program

Grundy County offers a pre-negotiated, three-year property tax abatement to qualifying companies. Eligible companies with qualifying projects can receive an abatement of:

- 75% during the first fully assessed tax year

- 50% the second year

- 25% the third year

Grundy County also offers four and five-year property tax abatements at 50% each year to qualifying high impact companies.

For more information, click the links below:

Grundy Incentives

Tax Abatement Application

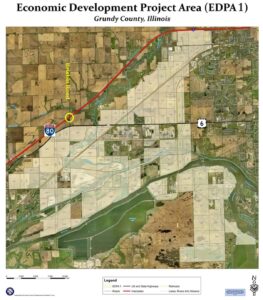

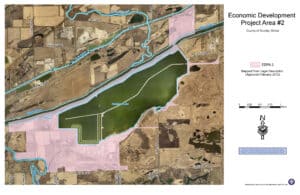

Economic Development Project Area (EDPA)

Offering a competitive advantage in the State of Illinois and Chicagoland market, the EDPA zones in Grundy County provide a mechanism for significant tax relief for new industrial investors and existing businesses looking to reinvest in current facilities. Here is how the EDPA can work for you:

- Allows a company to negotiate its tax bill with the County of Grundy by reimbursing eligible costs

- All ordinances and approvals are in place

- EDPA 1 – 12,000 acre zone with assessment levels frozen at 2006 values

- EDPA 2 – 2,000 acre zone with assessment levels frozen at 2012 values

For more information click the links below:

Tax Rebate Application

EDPA Flyer

For additional information contact the GEDC.

TIF Districts

TIF Districts Located in Grundy County

Tax Increment Financing (TIF) districts allow communities to capture the increases in local property taxes (the increment) that result from a redevelopment project. Increment can be used to pay for a variety of eligible costs such as public infrastructure, training, relocation expenses, and much more. To view the community TIF maps, click the links below:

Enterprise Zones

Enterprise Zones Located in Grundy County

Grundy County has two enterprise zones and the benefits include:

- Sales Tax Deduction

- Investment Tax Credit

- Machinery and Equipment Sales Tax Exemption

- Utility Tax Exemption

- Gas Use Tax Exemption

Enterprise zones were developed by the State of Illinois to stimulate industrial growth and retention in regional areas. The two zones serving Grundy County were established in 2016. The zones are powerful tools designed to mitigate costs related to private investment and job creation.

To see the Grundy County areas included in Enterprise Zones click the links below:

State Incentives

Several programs are available through the State of Illinois’ Department of Commerce & Economic Opportunity.

For an overview of state incentives, visit https://www.illinois.gov/dceo.

Financial Resources

SBA Info – Training, consulting and counseling for small business owners is available through Joliet Junior College and Starved Rock Alliance. To learn more, visit the websites below.

Joliet Junior College – Entrepreneur & Business Center (EBC)

Email: [email protected]

Starved Rock County Alliance – SBDC

Phone: 844-369-8898

Email: [email protected]

Financial – The Upper Illinois River Valley Development Authority is a general development agency serving the Counties of Bureau, Grundy, Kane, Kendall, LaSalle, Marshall, McHenry and Putnam. UIRVDA can issue bonds that can finance capital improvements and can reduce the rate of interest. For more information visit: www.uirvda.com